Illinois Cleaning Business Start-up Laws

This article provides three key state business start-up requirements for self-employed sole proprietors and general partners who run residential house cleaning businesses.

Information from the Secretary of State, the Illinois State Department of Revenue and selected city and county government sources were used to research this article.

Be aware that sole proprietor and general partner start-up requirements in this state are always changing. Some requirements even vary from county to county.

It is important that you call or visit your local county or city government in person or online to find out local requirements for residential house cleaning businesses and home-based businesses.

This article is not intended to be exhaustive or a substitute for qualified legal or tax advice.

Business Name Registration

Sole proprietors and general partners who want a business name that does not include the owner(s) full legal names (for example, Janice Smith’s Cleaning Service or Martha Harris and Tom Graham’s Maid Service) need to find out whether the name they want to use is available in the county where the business is based.

Start with a search of business names currently in use by incorporated businesses in Illinois.

Do Your Own Search Online For Business Names

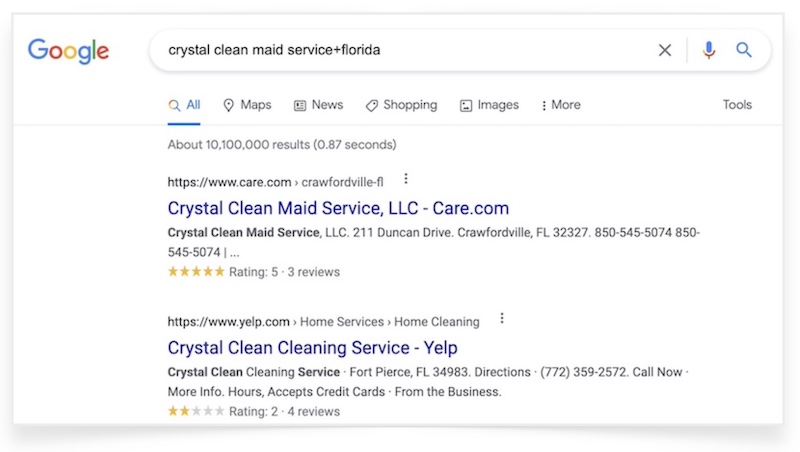

Then do an online search for names similar to the one you plan to use. For example, if you want to use the name, Crystal Clean Maid Service, do simple Google searches for “Crystal Clean Maid Service+Illinois” plus Crystal Clean Maid Service+your county” and “Crystal Clean Maid Service+your town or city”.

Search beyond the first page of results. Go at least five pages deep into the search results to see if the name you want or similar names are being used in your state, county or city.

Related:

Name Registration Details

Sole proprietors and general partners must register a business name with a local county clerk for an Assumed Name or DBA (“doing business as” name) certificate.

If the company name is available, fill out the Assumed Name registration form and have it notarized. Then file it with the county clerk’s office.

The county clerk should be able to provide copies of the Assumed Name Certificate, so be sure to request certified copies, for your bank and your business records.

Find an Illinois County Clerk and Recorder by searching for “Illinois county clerk+your county name“.

Publish Your Business Name

After registering an Assumed Name or DBA with the county, businesses must publish their Assumed Names once a week for 3 successive weeks in a local county newspaper within 15 days of registration.

Name Rights

In the state of Illinois, registering an Assumed Name or DBA certificate does not guarantee a business sole rights to the use of that name.

Other businesses in the state may also register the same fictitious name. Registered businesses are expected to legally defend their trade names.

Not Sure Where To Begin?

The Get Started Checklist and Workbook will help you set up your house cleaning or maid service business step by step without getting stuck or lost.

Get Started Checklist and Workbook

Get yours today!

Business License Registration

Sole proprietors and general partners do not have to apply for a business license with the State of Illinois.

Residential house cleaning service businesses must apply for a business license at their city and county clerk’s offices.

Find an Illinois County Clerk and Recorder by searching for “Illinois county clerk+your county name“.

Related: Get more details about licensing your cleaning business.

General Partner Licensing

In Illinois, a general partnership is created when two or more owners form an oral or written agreement to start a business together. General partners are not required to file any documents with the Secretary of State.

It is advisable for general partners to file an Assumed Name or DBA in the county.

A written partnership agreement drawn up by a lawyer is important for both or all partners. Partnership agreements do not have to be filed with the state.

👥 Start a solid partnership with help from the Business Partnership Portal.

How an EIN Helps

Sole proprietors and general partners may apply for an Employer Identification Number (EIN) from the IRS even if they do not plan to hire employees.

Getting an EIN may make it easier to open a bank account and reduce your risk of identity theft.

You can apply for an EIN online.

In addition, some business registration forms will require a a NAICS business classification number for the house cleaning industry.

Business Tax Registration

All businesses located in Illinois must register with the Illinois Department of Revenue.

Residential house cleaning services are not taxable in Illinois. Cleaning services do not have to collect and send sales taxes to the Department of Revenue.

Sole proprietors and general partners pay tax on business income to the state of Illinois through their personal state tax return.

Related: Get a deeper understanding of cleaning business taxes.

State Estimated Tax

Sole proprietors and general partners are responsible for paying estimated self-employment income taxes in Illinois (on Form IL-1040-ES) similar to the way self employment taxes are paid to the federal government.

Get more information about estimated tax requirements by calling the Illinois Department of Revenue at (800) 732-8866.

State Partnership Tax

Illinois general partnerships that file a Federal partnership information Form 1065, may need to file state income tax Form IL-1065. Partnerships are also required to pay the the state’s personal property replacement tax at a rate of 1.5% of net income.

Get more information from a CPA or qualified tax preparer to find out if your partnership must file those returns.

Selected Illinois City Licenses

Aurora Business License: The city of Aurora does not require a business license for residential house cleaning services.

Bloomington Business License: The city of Bloomington does not require a business license for residential house cleaning services.

Champaign Business License: https://champaignil.gov/starting-your-business/

Chicago Business License: https://www.chicago.gov/city/en/depts/bacp/provdrs/bus/svcs/apply_for_a_businesslicenseonline.html

Cicero Business License: http://thetownofcicero.com/departments/business-licenses/

Decatur Business License: The city of Decatur does not require a business license for residential house cleaning services.

Elgin Business License: https://www.cityofelgin.org/1079/Business-License

Evanston Business License: https://www.cityofevanston.org/business/business-licenses/

Joliet Business License: https://www.joliet.gov/government/departments/city-clerk-s-office/business-services/business-license-applications

Naperville Business License: https://www.naperville.il.us/services/permits–licenses/

Peoria Business License: The city of Peoria does not require a business license for residential house cleaning services.

Rockford Business License: The city of Rockford does not require a business license for residential house cleaning services..

Springfield Business License: The city of Springfield does not require a business license for residential house cleaning services.

Waukegan Business License: https://www.waukeganil.gov/162/Getting-Started

Hello,

Where do I get a small cleaning business license in the town of Odell, State of Illinois, county of Livingston?

Thank you,

Shari Breeden

Hi Shari,

Call or email the City or Town Clerk in Odell first. They will be able to tell you if you need a business license from Odell or Livingston County. You may need both.

So should i apply for a ein number for a residential cleaning company?

Hi Erica,

Yes you should.

Residential cleaning companies should apply for an Employment Identification Number (EIN) from the IRS even if they do not plan to hire W-2 employees. Getting an EIN may make it easier to open a bank account and reduce your risk of identity theft. You can apply for an EIN online.

If I file for a business license with my city and the application asks for my address where I do business and to attach a copy of the lease but I’m not on the lease of rented property will this affect my business license acceptance? If yes, can I rent a room in someone’s house for $10/month to do business or how does that work? Would I need renters insurance for business in that house?

Hi Stephanie,

You will need to get information about leasing and licensing directly from whoever handles business licensing in your area. That could be your local city or county clerk’s office. Each city and county has its own rules.

While you can rent a room in someone’s house as your base of operations, you need to have a high level of trust in your landlord. You will need a secure location to keep customer keys, supplies and any information about your customers that you don’t keep on your phone or laptop. Whether you need renter’s insurance or just a rider on your general business liability insurance is a question best answered by your insurance agent.

Thank you so much for sharing this information! It is so helpful. Is a PO Box an acceptable address for the business license application?

Hi Jess,

I’ve used a PO Box for my business over 20 years. To be on the safe side, call or email the number on your license application.

Is it necessary to publish your DBA or business name in the newspaper for three consecutive weeks? If so, why is it and how would I go about publishing the business

Hi Alison,

According to Illinois state law is is necessary to publish your DBA in a county newspaper.

Your county clerk’s office can tell you why and how to go about publishing your business name.

There is a link to Illinois County clerks and recorders on this page under Name Registration Details.

Hello Judith,

I am trying to set up a cleaning service in Chicago. I have looked online at the Chicago business website, but nothing is coming up under that category, so I am a bit confused. can Can I just register my business, obtain an ein number and start my services? thank you

Hi Shakira,

Illinois is a state that requires registration with county and city officials so it’s important you contact the city of Chicago to get the ball rolling.

If you follow the Chicago city link at the end of this Illinois Start-up page, there is a link in the first section of the page with the words Business Licensing: What Do I Need?.

Click or tap on that link and you will be taken to the Chicago Business Licensing page. That page gives instructions on how to apply and application requirements.

If you click on APPLY ONLINE, you can set up an account to apply online or go to the Chicago Direct Small Business Center.

On the Contact Us page of the Chicago Business Direct page are phone numbers for business license related questions.

You can call someone in city government who can give you the information you need to get started. Call (312)74-GOBIZ (312-744-6249) between hours of 8:00 a.m. to 5:00 p.m. CST Monday – Friday.

The city of Chicago also offers walk-in consultations at 121 N. LaSalle Street, Room 800.

If you choose to call or walk-in you should be able to get the exact information you need to start a cleaning business in Chicago.

Shakira, I have to agree with you. It took a lot of links and steps to find that information. Some cities do a better job of giving a new business owner the information they need the first time.

Thank you so much for the detailed information Judith.

Hello Shakira,

Can I be my own register agent for my cleaning business?

and as a LLC due I charge taxes for my clean business?

Thanks!

In Illinois, can I charge/add taxes to my clients for my house cleaning services?

Hi Ray,

In the state of Illinois, residential house cleaning services are not taxable.

If your county or city requires sales taxes, you can charge/add taxes to customer payments. The sales tax portion should be clearly marked on the invoice.

Remember to separate the tax funds after you deposit the payments so you don’t “accidentally” use sales tax money for anything else.