Maryland Cleaning Business Start-up Laws

This article provides three key state business start-up requirements for self-employed sole proprietors and general partners who run residential house cleaning businesses.

Information from the Secretary of State, the Comptroller of Maryland and selected city and county government sources were used to research this article.

Be aware that sole proprietor and general partner start-up requirements in this state are always changing. Some requirements even vary from county to county.

It is important that you call or visit your local county or city government in person or online to find out local requirements for residential house cleaning businesses and home-based businesses.

This article is not intended to be exhaustive or a substitute for qualified legal or tax advice.

Business Name Registration

Sole proprietors and general partners who want a business name that does not include the owner(s) full names (for example, Janice Smith’s Cleaning Service or Martha Harris and Tom Graham’s Maid Service) need to find out whether the name they want to use is available in the state of Maryland.

It is important to remember that the name must be different from any other name already registered with the state.

Start with a business name search to avoid legal problems and customer confusion.

Do Your Own Search Online For Business Names

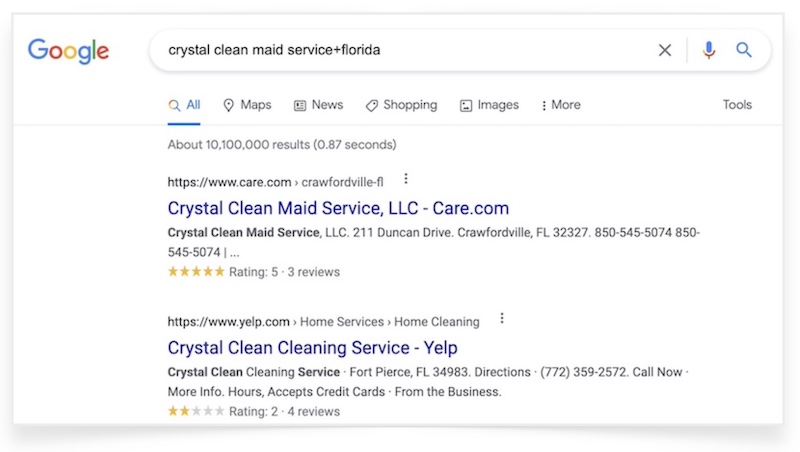

Then do an online search for names similar to the one you plan to use. For example, if you want to use the name, Crystal Clean Maid Service, do simple Google searches for “Crystal Clean Maid Service+Maryland” plus Crystal Clean Maid Service+your county” and “Crystal Clean Maid Service+your town or city”.

Search beyond the first page of results. Go at least five pages deep into the search results to see if the name you want or similar names are being used in your state, county or city.

Related:

Name Registration Details

Sole-proprietorships and general partnerships that choose to file a DBA (“doing business as”) or Trade Name Application can do so using Maryland’s online business portal known as the Maryland Business Express.

Name Rights

In the state of Maryland, registering a Trade Name does not guarantee a business sole rights to the use of that name.

While the state checks the name against other registered trade names filed with the state, other businesses in the state may also register the same Trade Name in other states or federally and use them in Maryland.

Registered businesses are expected to legally defend their trade names.

Not Sure Where To Begin?

The Get Started Checklist and Workbook will help you set up your house cleaning or maid service business step by step without getting stuck or lost.

Get Started Checklist and Workbook

Get yours today!

Business License Registration

All businesses in Maryland must be licensed by the state. Register for a state business license through the Maryland Business Express.

Related: Get more details about licensing your cleaning business.

General Partner Licensing

In Maryland, a general partnership is created when two or more owners form an oral or written agreement to start a business together.

It is advisable for general partners to file for a DBA (“doing business as”) or Trade Name Application. A written partnership agreement drawn up by a lawyer is important for both or all partners. Partnership agreements do not have to be filed with the state.

👥 Start a solid partnership with help from the Business Partnership Portal.

How An EIN Helps

Sole proprietors and general partners may apply for an Employer Identification Number (EIN) from the IRS even if they do not plan to hire employees.

Getting an EIN may make it easier to open a bank account and reduce your risk of identity theft.

You can apply for an EIN online.

In addition, some business registration forms will require a NAICS business classification number for the house cleaning industry.

Business Tax Registration

Register through the Maryland Business Express for business taxes and Annual Reports to the state.

Residential house cleaning services are not taxable in Maryland. House cleaning services do not have to collect and send sales taxes to the State Department of Assessments & Taxation (SDAT) or Office of the Comptroller.

Income from sole proprietorships is taxed as individual income on state tax returns.

Related: Get a deeper understanding of cleaning business taxes.

State Estimated Tax

Sole proprietors and general partners are responsible for paying estimated self-employment income taxes in Maryland (on Form PVW) similar to the way self employment taxes are paid to the federal government.

Get more information about estimated tax requirements by calling the Comptroller of Maryland’s Office at 1-800- 638-2937 or from Central Maryland 410-260-7980.

State Partnership Tax

Maryland general partnerships that file a Federal partnership information Form 1065, may need to file state income tax Form 1120. Get more information from a CPA or qualified tax preparer to find out if your partnership must file those returns.

Maryland Tax On Partnership Income

Maryland requires partnerships to pay income tax on income earned by partners who live out of state. In addition, each individual partner must pay Maryland state tax on his or her share of the partnership’s income.

Selected Maryland City Licenses

Note: Local city and county business licenses can be filed with the Clerk of the Circuit Court in each Maryland county. Find your County Clerk of the Circuit Court.

Baltimore Business License: https://finance.baltimorecity.gov/bureaus/collections

Note: Click on Annual Business License Application or call City of Baltimore’s Department of Revenue Collections’ Miscellaneous Tax & Licensing Unit at (410) 361-9690

Bowie Business License: City of Bowie Planning and Economic Development Department

15901 Excalibur Road

Bowie, MD 20716

Contact by telephone at 301-262-6200. Monday through Friday 8:30 a.m. to 5:00 p.m.

Frederick Business License: https://www.courts.state.md.us/clerks/frederick/business

Gaithersburg Business License: https://www.montgomerycountymd.gov/Biz-Resources/licenses-permits.html

Hagerstown Business License: https://www.hagerstownmd.org/582/Licenses

Rockville Business License: https://montgomerycountymd.gov/cct/business-license.html

Hello,

I am try to start a house keep business and I want to know, how I can get clients. My employees base will be single mothers and low income. I haven’t started yet, so please advise. Thanks

Hi Fatu,

A lot of great tips on how to start your business and get your first clients can be found in my two part series: Start A Cleaning Business At Square One-Part 1 and Start A Cleaning Business At Square One-Part 2.

One inexpensive way to bring in new clients is through old-fashioned paper flyers.

Good luck with your new business, Fatu!

I am trying to get a cleaning business license in Baltimore, how can I get it please

Hi Orphee,

Scroll up on this same page. A link to license information for Baltimore City is listed.